What is Health Insurance?

Health insurance is a type of insurance that covers medical expenses incurred by an individual or a group of people. It is a contract between an insurance company and the insured person, where the insured person pays a premium, and in return, the insurance company agrees to pay for their medical expenses. The purpose of health insurance is to provide financial protection against the high cost of medical treatment, which can be expensive and difficult to afford without insurance coverage.

Health insurance plans can vary significantly in terms of coverage, cost, and benefits. Some plans cover only basic medical expenses, while others provide comprehensive coverage for a wide range of medical services, including preventive care, hospitalization, and prescription drugs. The cost of health insurance also varies depending on factors such as age, health status, and the level of coverage needed.

In addition to these traditional health insurance plans, there are also newer options such as health savings accounts (HSAs) and high-deductible health plans (HDHPs). HSAs are tax-advantaged savings accounts that can be used to pay for qualified medical expenses, while HDHPs have lower monthly premiums but require the insured person to pay a higher deductible before insurance coverage kicks in.

While health insurance can be expensive, it is essential to have coverage to protect against unexpected medical expenses. Without insurance, the cost of medical care can be overwhelming and can even lead to bankruptcy in some cases. Additionally, having health insurance encourages preventive care and early detection of health problems, which can improve overall health outcomes and reduce the cost of healthcare in the long run.

Type of Health Insurance

Health insurance is a critical part of healthcare planning, and there are many types of health insurance plans to choose from. Different types of health insurance have different levels of coverage, costs, and benefits, making it important to understand the options available to you. In this article, we’ll explore some of the most common types of health insurance plans.

- Indemnity Plans

Indemnity plans, also known as fee-for-service plans, allow you to choose any healthcare provider you want, and they will pay for a portion of your medical expenses. Indemnity plans offer the most flexibility, but they also tend to be more expensive than other types of plans.

- Health Maintenance Organization (HMO) Plans

HMO plans require you to choose a primary care physician (PCP) who will manage all of your healthcare needs. If you need to see a specialist, your PCP will refer you to someone within the HMO network. HMO plans offer less flexibility than other types of plans, but they also tend to be less expensive.

- Preferred Provider Organization (PPO) Plans

PPO plans offer more flexibility than HMO plans, allowing you to choose any healthcare provider you want, even if they’re not in the plan’s network. If you choose a provider outside of the network, you’ll typically pay more out of pocket. PPO plans tend to be more expensive than HMO plans but less expensive than indemnity plans.

- Point of Service (POS) Plans

POS plans are a hybrid of HMO and PPO plans. You’ll need to choose a primary care physician who will manage your healthcare needs, but you’ll also have the option to see providers outside of the plan’s network. If you see a provider outside of the network, you’ll typically pay more out of pocket. POS plans tend to be more expensive than HMO plans but less expensive than indemnity plans.

- High-Deductible Health Plans (HDHPs)

HDHPs are becoming increasingly popular because they tend to have lower monthly premiums than other types of plans. However, they also require you to pay a high deductible before your insurance coverage kicks in. HDHPs are typically paired with a health savings account (HSA), which allows you to save pre-tax dollars to pay for qualified medical expenses.

- Catastrophic Health Insurance

Catastrophic health insurance is designed to protect you against major medical expenses, such as hospitalizations or surgeries. These plans typically have high deductibles and low monthly premiums. Catastrophic health insurance is generally only available to people under the age of 30 or those who meet certain income requirements.

In conclusion, there are many types of health insurance plans available, and the right plan for you will depend on your healthcare needs, budget, and personal preferences. It’s important to understand the differences between the various types of plans so that you can make an informed decision about your healthcare coverage. Consider working with a licensed insurance agent or healthcare provider to help you choose the best plan for you.

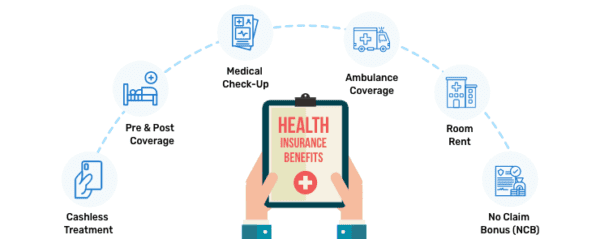

Benefits of Health Insurance

Health insurance is a type of insurance policy that provides coverage for medical expenses and treatments, and it offers a wide range of benefits to policyholders. Health insurance can help you manage your healthcare expenses and provide peace of mind in the event of a medical emergency. In this article, we’ll explore some of the many benefits of health insurance.

- Access to Medical Care

One of the most significant benefits of health insurance is access to medical care. With a health insurance policy, you can get the medical attention you need when you need it. Your policy can cover the cost of doctor visits, diagnostic tests, surgeries, hospitalizations, and other medical treatments. Health insurance can help you stay healthy and treat any medical conditions or illnesses as soon as they arise.

- Financial Protection

Medical treatments and procedures can be expensive, and without health insurance, you could be responsible for paying the full cost out of pocket. Health insurance provides financial protection by covering all or a portion of your medical expenses. Depending on your policy, you may be responsible for paying a deductible, copayment, or coinsurance. However, even with these costs, health insurance can save you significant amounts of money in the long run.

- Preventive Care

Most health insurance policies cover preventive care, which includes routine check-ups, vaccinations, and screenings for diseases and illnesses. Preventive care can help you stay healthy and detect any potential medical issues early on, which can lead to better health outcomes and lower medical costs in the long run.

- Mental Health Care

Many health insurance policies also cover mental health care, including therapy, counseling, and medication. Mental health care is an important aspect of overall health and wellness, and having access to these services can be life-changing for people with mental health conditions.

- Prescription Medications

Prescription medications can be expensive, especially for people with chronic conditions that require ongoing treatment. Health insurance policies often provide coverage for prescription medications, which can make these treatments more affordable and accessible.

- Improved Quality of Life

Finally, having health insurance can improve your quality of life by providing peace of mind and reducing financial stress. Knowing that you’re covered in the event of a medical emergency can help you feel more secure and less anxious about your health.

Requirements of Health Insurance

Health insurance is a crucial part of managing your healthcare costs and ensuring access to medical care. While health insurance requirements can vary depending on the policy and the state you live in, there are some basic requirements that apply to most policies. In this article, we’ll explore some of the most common requirements of health insurance.

- Premiums

The premium is the amount of money you pay each month to maintain your health insurance coverage. Premiums vary based on the type of plan you have, your age, and other factors. In general, you will be required to pay your premiums on time to keep your coverage in force.

- Deductibles

A deductible is the amount of money you must pay out of pocket before your health insurance coverage kicks in. Deductibles can vary depending on your plan, and some plans have no deductible at all. It’s important to understand your deductible and how it works so you can plan for your healthcare costs.

- Copayments and Coinsurance

Copayments and coinsurance are the amounts you pay out of pocket for medical services after you’ve met your deductible. Copayments are a fixed amount you pay for certain services, such as a doctor’s visit or a prescription medication. Coinsurance is a percentage of the cost of a medical service that you’re responsible for paying.

- Coverage for Pre-Existing Conditions

Under the Affordable Care Act, health insurance policies cannot deny coverage or charge more for people with pre-existing conditions. This means that if you have a medical condition before enrolling in health insurance, your policy cannot exclude coverage for that condition.

- Coverage for Essential Health Benefits

Health insurance policies are required to cover essential health benefits, which include preventive care, emergency services, hospitalization, prescription medications, and mental health care. The specific benefits covered can vary depending on your plan, but all policies must cover these essential health benefits.

- Network Requirements

Health insurance policies often have network requirements, which means you may be required to see healthcare providers within a certain network to receive coverage. If you see a provider outside of your network, you may be responsible for paying more out of pocket. It’s important to understand your network requirements so you can choose healthcare providers that are covered by your policy.

List of Recommended International Life Insurance Company

Health insurance companies are organizations that provide insurance coverage for healthcare services to individuals, families, and businesses. These companies offer a variety of health insurance plans with different levels of coverage and costs. In this article, we’ll explore some of the top health insurance companies in the United States.

UnitedHealth Group is one of the largest health insurance companies in the United States, providing coverage to over 45 million people. They offer a variety of health insurance plans, including individual, family, and group plans. UnitedHealth Group also offers Medicare Advantage plans and Medicaid plans.

Anthem is a health insurance company that operates in several states, including California, Colorado, Indiana, Kentucky, and Virginia. They offer individual, family, and group health insurance plans, as well as Medicare Advantage and Medicaid plans. Anthem is known for its wide network of healthcare providers and competitive pricing.

Aetna is a health insurance company that provides coverage to individuals, families, and businesses. They offer a variety of health insurance plans, including HMOs, PPOs, and high-deductible health plans. Aetna also offers Medicare Advantage and Medicaid plans. Aetna is known for its emphasis on wellness and preventive care.

Cigna is a global health insurance company that provides coverage to individuals, families, and businesses in the United States. They offer a variety of health insurance plans, including HMOs, PPOs, and high-deductible health plans. Cigna also offers Medicare Advantage and Medicaid plans. Cigna is known for its focus on improving healthcare quality and affordability.

Humana is a health insurance company that provides coverage to individuals, families, and businesses. They offer a variety of health insurance plans, including HMOs, PPOs, and high-deductible health plans. Humana also offers Medicare Advantage and Medicaid plans. Humana is known for its focus on promoting healthy lifestyles and disease prevention.

Kaiser Permanente is a health insurance company that operates in several states, including California, Colorado, Georgia, Hawaii, and Virginia. They offer individual, family, and group health insurance plans, as well as Medicare Advantage and Medicaid plans. Kaiser Permanente is known for its integrated healthcare model, which combines insurance coverage with healthcare services.

In conclusion, health insurance is a valuable tool for protecting against the high cost of medical care. Understanding the different types of health insurance plans and the benefits they offer can help individuals and families make informed decisions about their healthcare coverage needs.

FAQ of Health Insurance

Q: What is health insurance?

A: Health insurance is a type of insurance that provides coverage for medical expenses, including hospitalizations, doctor visits, prescription medications, and other healthcare services.

Q: Why is health insurance important?

A: Health insurance is important because it helps cover the cost of medical care. Without health insurance, medical bills can quickly add up and become unaffordable.

Q: What types of health insurance are available?

A: There are several types of health insurance, including HMOs, PPOs, EPOs, and POS plans. There are also short-term health insurance plans and catastrophic health insurance plans.

Q: How much does health insurance cost?

A: The cost of health insurance varies depending on factors such as your age, location, and the level of coverage you need. Some employers offer health insurance as a benefit to employees, while individuals can purchase health insurance through the marketplace or private insurance companies.

Q: What is a deductible?

A: A deductible is the amount of money you must pay out of pocket before your health insurance coverage kicks in. Deductibles can vary depending on your plan, and some plans have no deductible at all.

Q: What is coinsurance?

A: Coinsurance is the percentage of the cost of a medical service that you are responsible for paying after you have met your deductible.

Q: What is a copayment?

A: A copayment is a fixed amount you pay for certain medical services, such as a doctor’s visit or a prescription medication.

Q: What is a pre-existing condition?

A: A pre-existing condition is a health condition that you had before enrolling in a health insurance plan.

Q: Are there any penalties for not having health insurance?

A: The Affordable Care Act requires individuals to have health insurance or face a penalty. However, this penalty has been reduced to $0 as of 2019.

Q: Can I keep my current doctor if I get health insurance?

A: It depends on the health insurance plan you choose. Some plans have networks of healthcare providers that you must choose from, while others allow you to see any provider you choose.

1 thought on “What is Health Insurance: Types, Benefits & Requirements”