What is Life Insurance

Life insurance is a contract between an individual and an insurance company that provides financial protection to the individual’s beneficiaries in the event of their death. In exchange for regular payments, known as premiums, the insurance company agrees to pay a lump sum of money to the beneficiaries named in the policy upon the policyholder’s death.

The purpose of life insurance is to provide peace of mind to individuals and their families. It can be difficult to think about one’s own mortality, but life insurance can help alleviate the financial burden that can come with unexpected death. This can include providing for funeral costs, paying off debts, and providing for loved ones who may depend on the policyholder’s income.

When selecting a life insurance policy, it’s important to consider factors such as coverage amounts, premiums, and any additional benefits that may be included. Factors such as age, health status, and lifestyle habits can also impact the cost of life insurance premiums.

To obtain life insurance, applicants typically undergo a medical exam and provide information about their health history. This helps the insurance company assess the risk of insuring the individual and determine the appropriate premium amount.

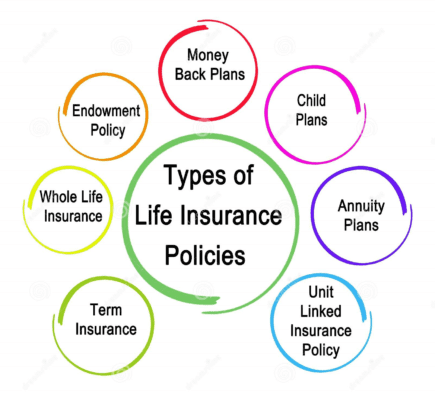

Type of Life Insurance

There are several types of life insurance policies available, each with its own benefits and requirements. Understanding the different types of life insurance can help individuals select the policy that best meets their needs.

- Term Life Insurance

Term life insurance is the most common type of life insurance policy. It provides coverage for a specific period of time, typically ranging from one to thirty years. If the policyholder dies during the term of the policy, the insurance company pays the beneficiaries the agreed-upon death benefit. If the policy expires before the policyholder dies, there is no payout. Term life insurance is often the most affordable option and can be a good choice for those who need temporary coverage.

- Whole Life Insurance

Whole life insurance provides coverage for the policyholder’s entire life and typically includes a savings component that can grow over time. Whole life insurance policies are more expensive than term policies but can provide additional benefits such as cash value accumulation and guaranteed death benefits. The policyholder pays a fixed premium for the entire life of the policy, and the death benefit is paid to the beneficiaries upon the policyholder’s death.

- Universal Life Insurance

Universal life insurance offers more flexibility in terms of premium payments and death benefits. Policyholders can adjust their premium payments and death benefits as needed, making universal life insurance a good choice for those who want more control over their policy. Universal life insurance policies also typically include a savings component, which can grow over time and be used to pay premiums or increase the policy’s death benefit.

- Variable Life Insurance

Variable life insurance is similar to whole life insurance, but the savings component is invested in a variety of investment options such as mutual funds, stocks, and bonds. The policy’s death benefit and cash value are tied to the performance of the investments. This type of policy can offer the potential for higher returns, but it also comes with greater risk.

- Survivorship Life Insurance

Survivorship life insurance, also known as second-to-die life insurance, covers two people and pays the death benefit when the second person dies. This type of policy is often used by couples who want to provide for their children or ensure that their estate is passed on to their heirs.

Benefits Life Insurance

The benefits of life insurance are numerous, but perhaps the most important is the peace of mind that it can provide. Knowing that your loved ones will be taken care of in the event of your death can provide a great deal of comfort and security. Life insurance can also help pay for final expenses, such as funeral costs, and can provide financial support for children and other dependents.

While the primary benefit of life insurance is the death benefit paid to beneficiaries, there are several other benefits that come with having a life insurance policy.

- Pays for Final Expenses

One of the most significant benefits of life insurance is that it can pay for final expenses, such as funeral and burial costs. Funerals can be expensive, and the cost can be a significant financial burden for families. A life insurance policy can help alleviate this burden and ensure that loved ones are not left with the financial burden of paying for final expenses.

- Provides Income Replacement

If the policyholder was the primary breadwinner for their family, the death benefit from a life insurance policy can provide income replacement for their loved ones. The death benefit can be used to pay for household expenses, such as mortgage payments, utility bills, and other daily expenses, helping to ensure that the family’s standard of living does not decline in the event of the policyholder’s death.

- Pays Off Debts

A life insurance policy can also be used to pay off outstanding debts, such as credit card balances, car loans, and other debts. This can help alleviate the financial burden on the family and ensure that they are not left with the responsibility of paying off debts that the policyholder incurred.

- Provides for Children’s Education

A life insurance policy can also be used to provide for the education of the policyholder’s children. The death benefit can be used to pay for college tuition and other educational expenses, helping to ensure that the policyholder’s children can continue their education and achieve their goals.

- Builds Cash Value

Some types of life insurance policies, such as whole life and universal life, include a savings component that can build cash value over time. This cash value can be borrowed against or used to pay premiums, providing a source of financial flexibility for the policyholder.

Life Insurance Requirements

Life insurance is an important financial product that can provide financial security and peace of mind to individuals and their families. While the requirements for life insurance policies can vary depending on the policy and the insurance company, there are some common requirements that individuals should be aware of when applying for life insurance.

- Age

Most insurance companies have a minimum age requirement for purchasing a life insurance policy, which is typically 18 years old. The maximum age for purchasing a policy can vary by insurance company and policy type, but it is usually around 80 years old.

- Health

Health is a critical factor in determining the cost of a life insurance policy, and insurance companies will require applicants to undergo a medical exam to determine their health status. This exam typically includes a physical exam, blood tests, and urine tests to screen for various health conditions. Insurance companies may also require applicants to provide their medical history and any medication they are taking.

- Lifestyle

Insurance companies will also consider an applicant’s lifestyle when determining their eligibility for a life insurance policy. This can include factors such as smoking, alcohol consumption, and risky hobbies or occupations. Applicants who engage in risky behaviors may face higher premiums or be denied coverage altogether.

- Financial Status

Insurance companies may also consider an applicant’s financial status when determining their eligibility for a life insurance policy. This can include factors such as income, assets, and outstanding debts. Insurance companies want to ensure that the death benefit provided by the policy is reasonable and that the policyholder is not overinsured.

- Application and Underwriting Process

The application and underwriting process for a life insurance policy can vary depending on the insurance company and policy type. Generally, applicants will need to fill out an application and provide their personal and health information. The insurance company will then review the application and determine the applicant’s eligibility for coverage.

List of Recommended International Life Insurance Company

When it comes to purchasing life insurance, there are many international insurance companies to choose from. Here are some of the top life insurance companies from around the world:

MetLife is one of the largest life insurance companies in the world, with operations in over 40 countries. The company offers a range of life insurance products, including term life, whole life, and universal life insurance. In addition to life insurance, MetLife also offers annuities, retirement planning, and other financial products.

AXA is a multinational insurance company that operates in over 50 countries. The company offers a variety of life insurance products, including term life, whole life, and universal life insurance. AXA also offers retirement planning, wealth management, and other financial services.

Prudential Financial is a global insurance and financial services company with operations in over 40 countries. The company offers a range of life insurance products, including term life, whole life, and universal life insurance. In addition to life insurance, Prudential also offers retirement planning, annuities, and other financial products.

Allianz is a multinational insurance company with operations in over 70 countries. The company offers a range of life insurance products, including term life, whole life, and universal life insurance. Allianz also offers annuities, retirement planning, and other financial products.

Aegon is a Dutch life insurance and financial services company that operates in over 20 countries. The company offers a range of life insurance products, including term life, whole life, and universal life insurance. In addition to life insurance, Aegon also offers annuities, retirement planning, and other financial products.

Zurich Insurance Group is a Swiss insurance company that operates in over 170 countries. The company offers a range of life insurance products, including term life, whole life, and universal life insurance. Zurich Insurance Group also offers property and casualty insurance, as well as other financial products.

There are many international insurance companies to choose from when it comes to purchasing life insurance. These companies offer a range of life insurance products, as well as other financial products, such as retirement planning and annuities. It’s essential to do your research and compare policies and prices to find the right insurance company and policy for your needs.

In conclusion, life insurance is an important tool for providing financial security and peace of mind to individuals and their families. With a variety of policies available, individuals can find the coverage that best meets their needs and budget. Whether it’s term, whole, or universal life insurance, having a policy in place can help ensure that loved ones are taken care of in the event of unexpected death.

FAQ of Life Insurance

Q: What is life insurance?

A: Life insurance is a contract between an individual and an insurance company in which the individual pays premiums, and in exchange, the insurance company provides a death benefit to the individual’s beneficiaries upon the individual’s death.

Q: Why do I need life insurance?

A: Life insurance can provide financial security to your loved ones in the event of your unexpected death. It can help cover expenses such as funeral costs, outstanding debts, and living expenses.

Q: What are the types of life insurance?

A: The three main types of life insurance are term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a set period, typically 10-30 years. Whole life insurance provides coverage for the duration of the policyholder’s life, and universal life insurance offers flexibility in premium payments and death benefits.

Q: How much life insurance coverage do I need?

A: The amount of life insurance coverage needed varies depending on individual circumstances, such as income, debt, and dependents. Generally, it’s recommended to have coverage equal to at least 10 times your annual income.

Q: How are life insurance premiums determined?

A: Life insurance premiums are determined based on several factors, including age, health, lifestyle, and the type of policy. Generally, younger and healthier individuals can receive lower premiums.

Q: Do I need a medical exam for life insurance?

A: It depends on the policy and the insurance company. Some policies require a medical exam to determine the applicant’s health status, while others do not. Policies that require a medical exam may have higher premiums for individuals with health conditions.

Q: Can I change my life insurance policy?

A: Yes, many life insurance policies offer flexibility in changing coverage amounts, payment options, and beneficiaries. It’s important to review your policy regularly and make any necessary changes as your circumstances change.

Q: Can I have multiple life insurance policies?

A: Yes, it’s possible to have multiple life insurance policies from different insurance companies or the same company. However, it’s important to ensure that the total coverage amount is not excessive and that premiums are affordable.

Q: How do I file a life insurance claim?

A: To file a life insurance claim, the beneficiary typically needs to contact the insurance company and provide the necessary documentation, such as the death certificate and policy information. The insurance company will then review the claim and distribute the death benefit accordingly.

1 thought on “What is Life Insurance? Its Types, Benefits & Requirements”